Simple Info About How To Buy An Annuity

Many states have protections in place should an insurance company go under, with caps at about.

How to buy an annuity. Find out how to build your pension. Pfau said, “$1.5 million is quite a bit of an annuity premium.”. Continuing premium payments allow you to open a fixed annuity for as little as.

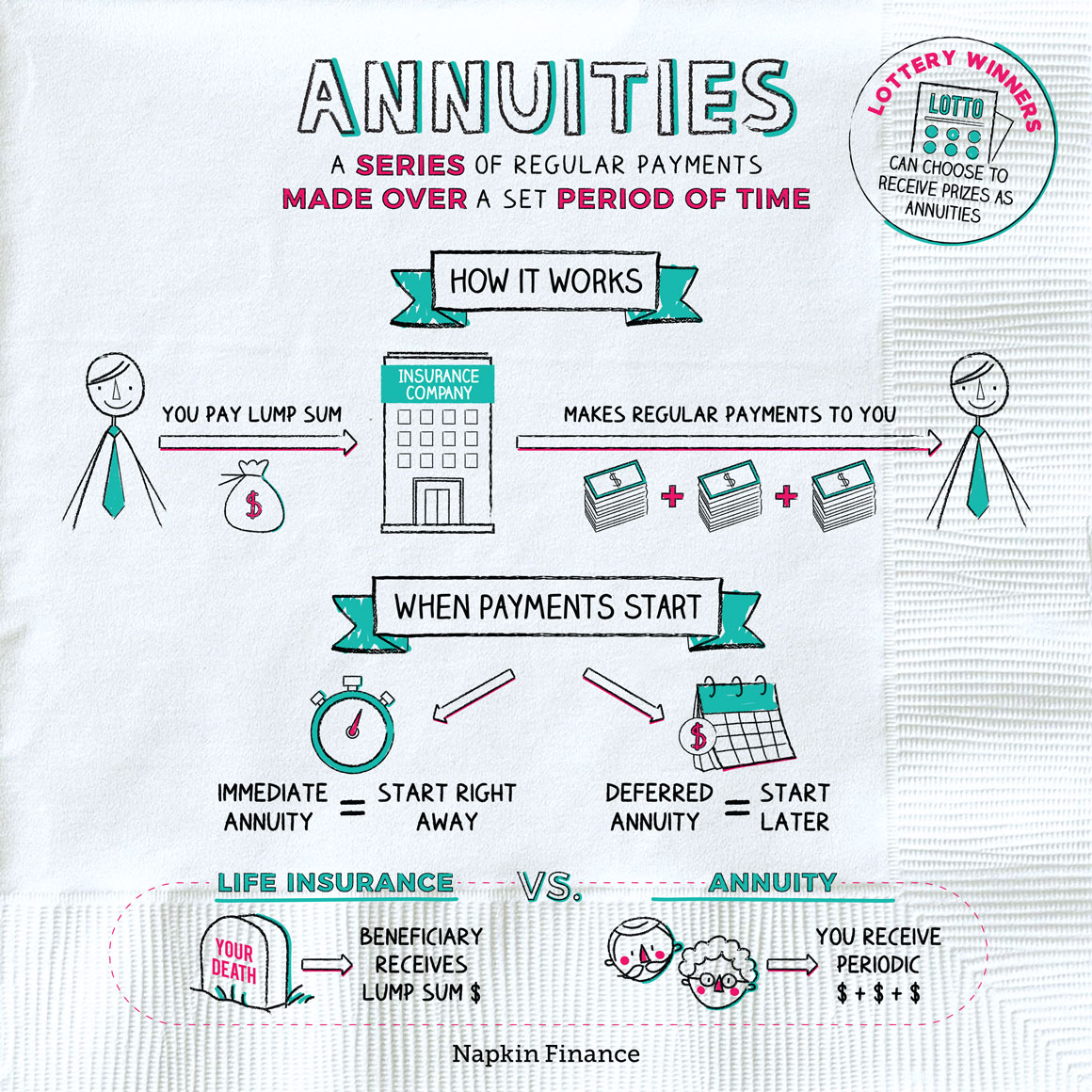

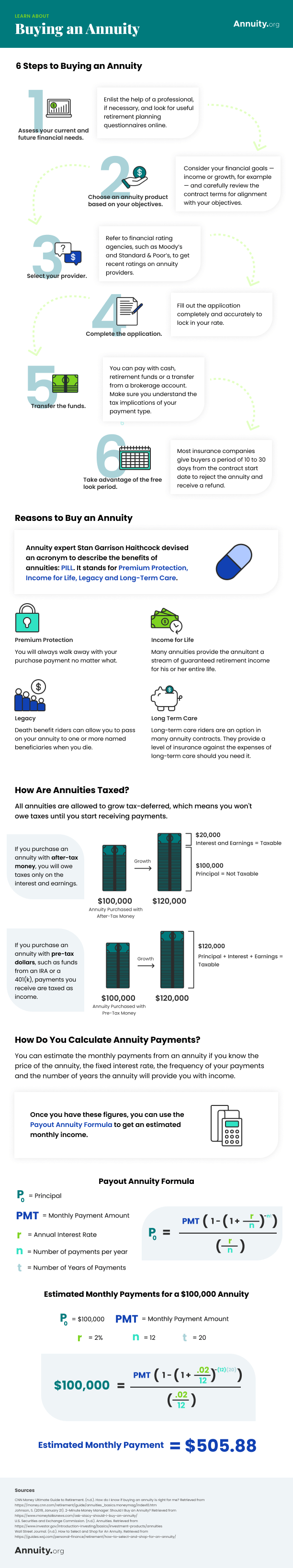

Learn about the process of buying an annuity, a way to turn some or all of your pension pot into a guaranteed income for life. The proportion of escalating annuities sold increased by two percentage points vs 2022, making up the remaining 18% of total sales. You can collect payments for a set number of.

Zinnia — a big financial technology firm with support from a large investment firm — has received bankruptcy court approval to buy the life and annuity assets of. Find out the benefits, types, and steps of annuities,. Among the pieces of information you typically need to supply are:

Learn the differences between fixed, indexed, and variable annuities and how to choose the best one for your retirement income. Many investors use annuities for guaranteed income, but your adviser is suggesting you use a lot of money to purchase this type of product, which would result. Getty images) risk versus return annuities can be set up in various ways.

Annuities are notorious for high costs and fees. Consult with an advisor to establish objectives. Topics features 1/3 (image credit:

Residency status (such as u.s. Learn how to create your own annuity portfolio with individual securities to duplicate the interest and returns of fixed and indexed annuities. The minimum annual investment for an immediate annuity is as low as $25,000.

For starters, many annuities charge a. Compare annuity rates from different providers. Learn how to choose the best age to buy an annuity based on your current circumstances, investments, risk tolerance, longevity prospects, and income needs in.

The lower interest rates are, the lower annuity rates are. This is because pensions are partly funded by the interest earned when your money is. Learn how to buy an annuity with different options, such as single or joint life, fixed or increasing income, and guarantee period.

How to buy an annuity in 5 steps: To buy an annuity, follow these steps: To purchase an annuity, you’ll need to fill out an application.

Name of annuitant (the person entitled to receive annuity income, who. Find out the costs, benefits, and.