Can’t-Miss Takeaways Of Info About How To Increase Federal Withholding

![Social Security Wage Base 2021 [Updated for 2023] UZIO Inc](https://www.mikloscpa.com/wp-content/uploads/2017/04/MiklosCPA-employee-federal-withholding-1.jpg)

Go to step2 or the part where the.

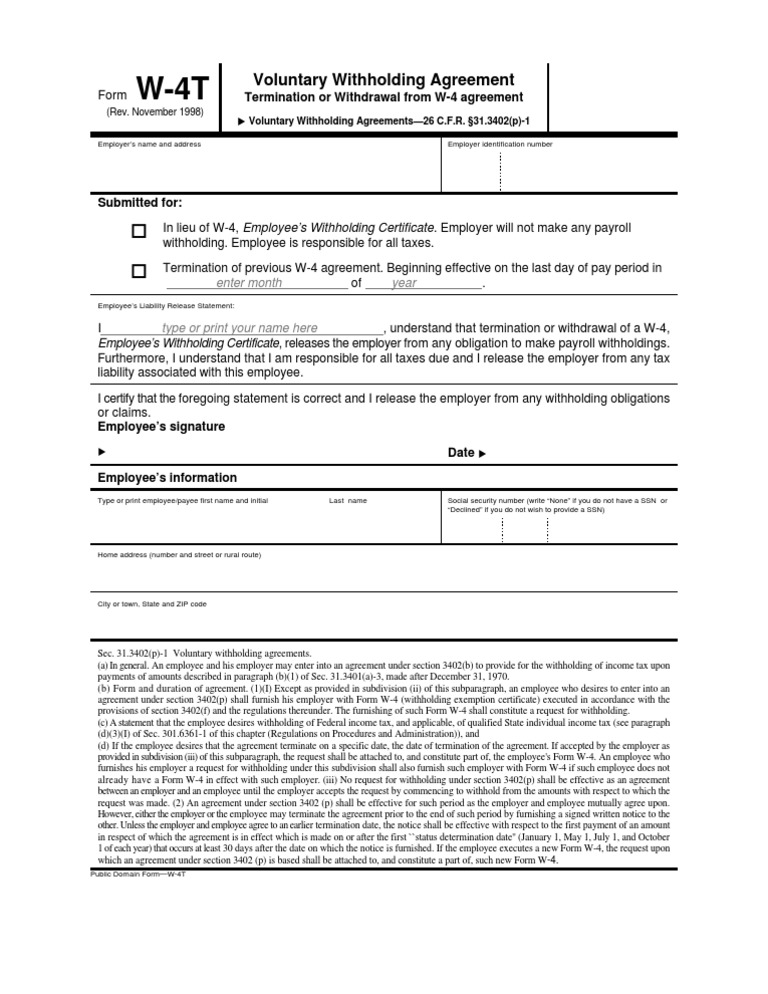

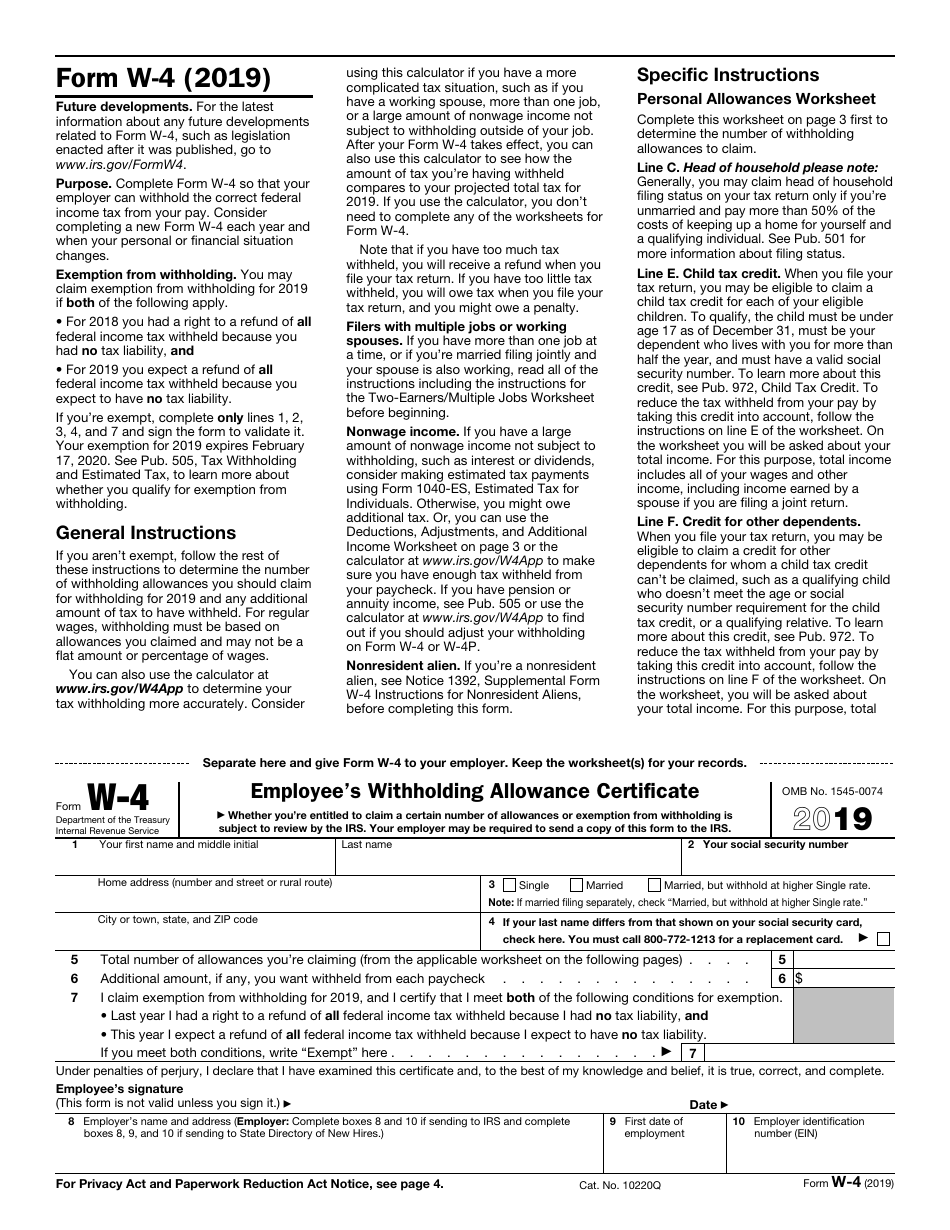

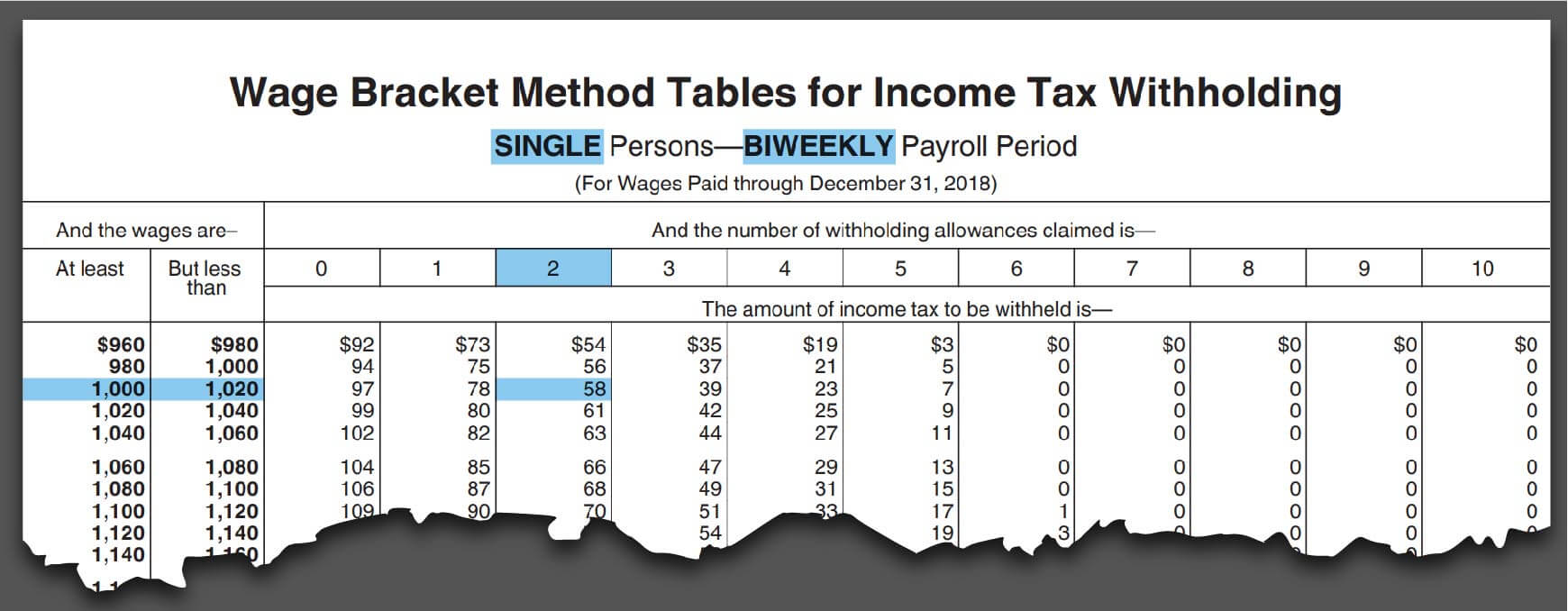

How to increase federal withholding. To change your tax withholding you should: Log on to servicesonline.opm.gov to start, change, or stop federal and state income tax withholdings; You can find the amount of federal income tax.

For federal tax withholding: Click the name of the employee, then click the pencil icon beside pay. Taxpayers are also encouraged to read publication 17, your federal income tax (for individuals) for additional guidance.

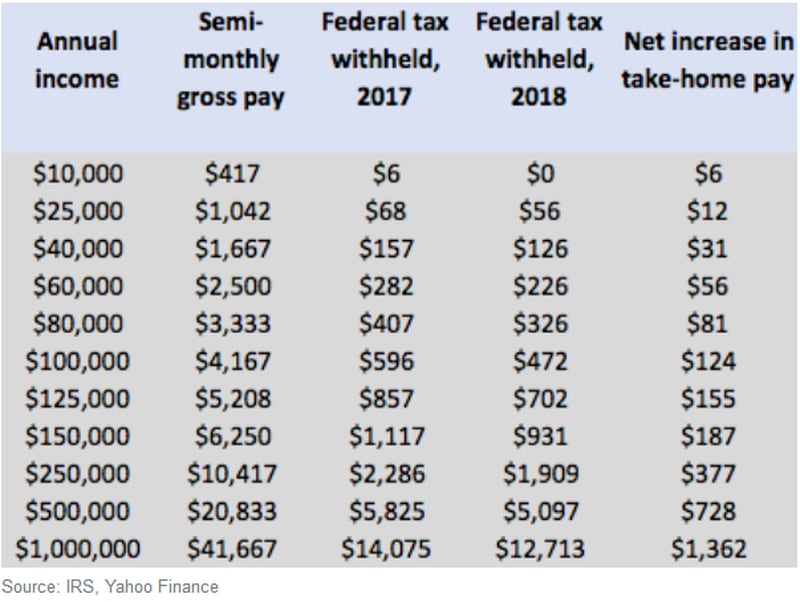

The tax withholding estimator compares that estimate to your current tax. Click federal tax withholdings in the menu to view, stop, or change your current federal withholdings make sure you save your changes before leaving the page. For those who owe, boosting tax withholding in 2019 is the best way to head off a.

If you’ve recently entered into or ended a marriage, you should adjust your tax withholding because your tax rate greatly depends on your filing. How to fill out an employee’s withholding certificate use our. Washington — the internal revenue service today urged taxpayers to check their tax withholding while there's time left in 2022 to benefit from any necessary.

Total up your tax withholding. This would come to a total of $6,307.51 of withholdings to cover your federal income tax this year. Let’s start by adding up your expected tax withholding for the year.

In this video you’ll learn: Marriage or divorce. You would owe $5,147 plus 22% of excess over $44,725.

Go to the payroll menu and select employees. You can use the tax withholding estimator to estimate your income tax for next year.

Adjust your additional withholding amount if needed.

![Social Security Wage Base 2021 [Updated for 2023] UZIO Inc](https://www.uzio.com/resources/wp-content/uploads/2021/09/Social-Security-Wage-Base-Table-2023-1024x791.png)