Unbelievable Tips About How To Start A Payroll Processing Company

The payroll processes and procedures that apply to your small business will vary depending on how the company is set up, where you are located, and the.

How to start a payroll processing company. Update policies and records: If too little is withheld, they may owe the irs. Start quote compare packages common frequently asked.

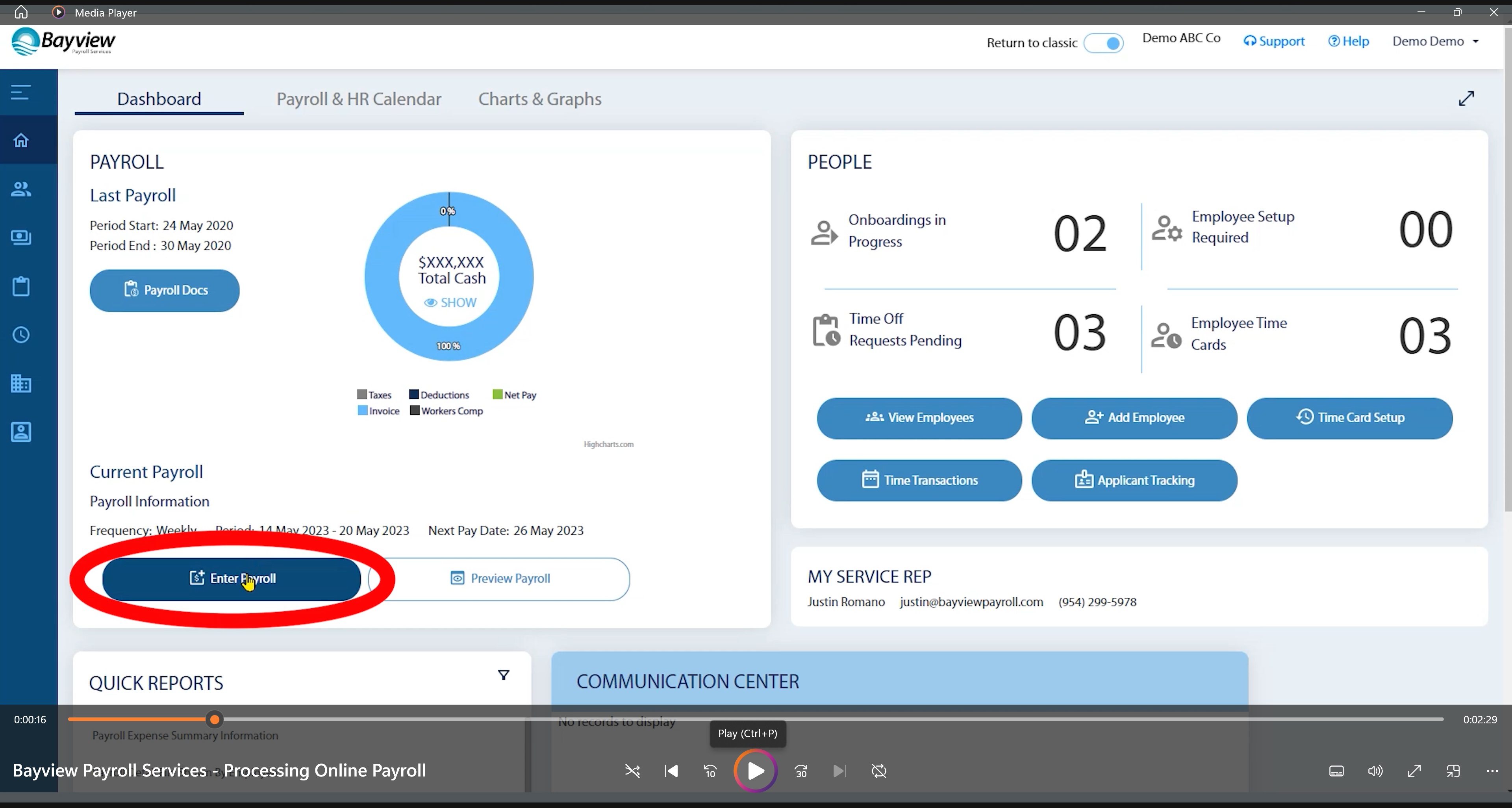

The final step involved in setting up payroll for small businesses is processing the payroll. Steps on how to start a payroll processing company memorable business name ideas for payroll processing company. Best hr + payroll service:

Your first step is to set up an employer identification number (ein) with the irs. To do payroll on quickbooks, you need to first create a quickbooks account and select a payroll plan. Follow these steps to process payroll:

Create a payroll policy 3. Setting up payroll may not be the first thing on your mind when you start a small business. Collect time sheets, review & approve.

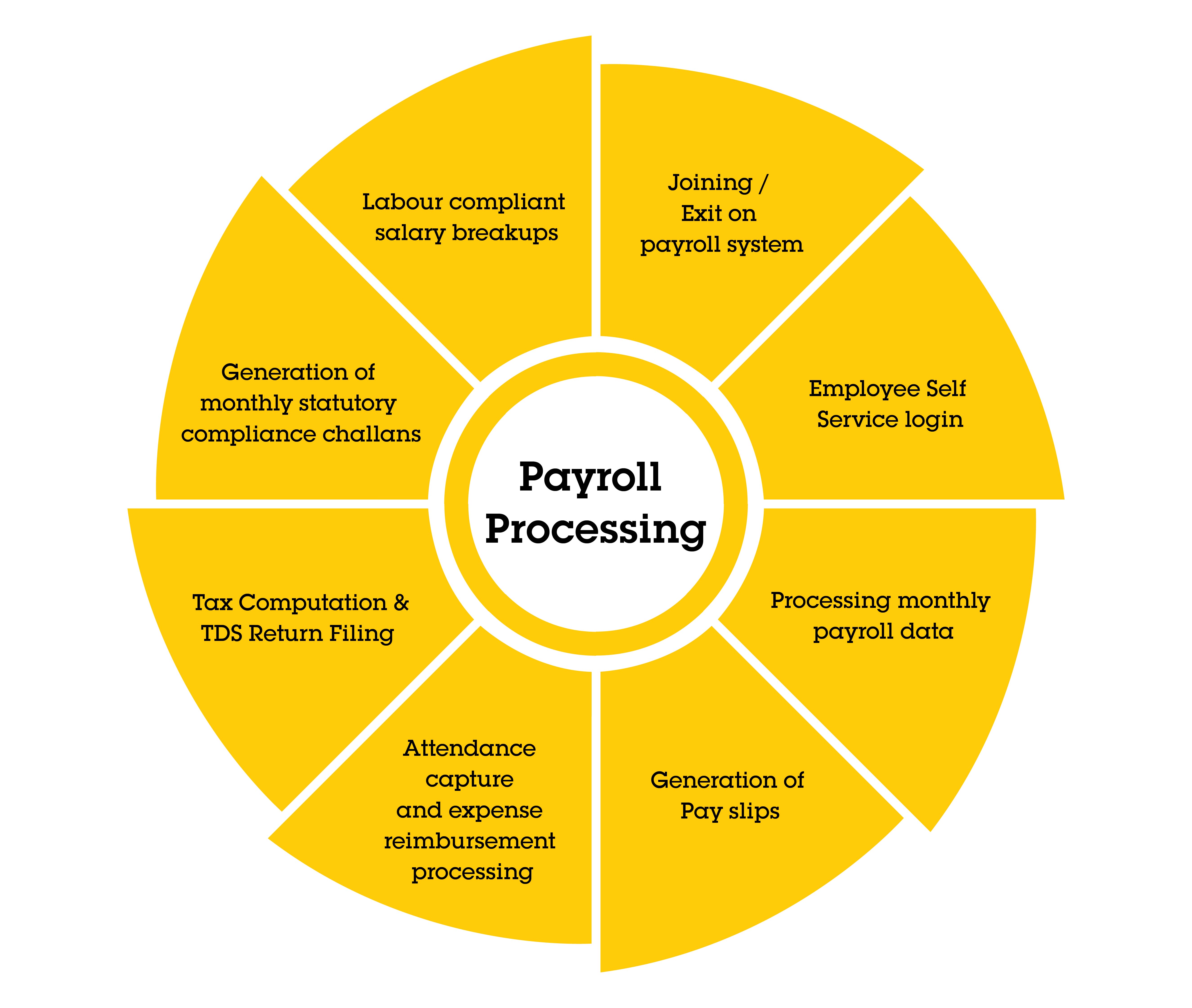

Generally, the payroll provider will: First, you will need to gather. Blue gates© payroll processing company, inc.

Now you’re ready to start collecting data on your employees’ work time to help determine how much you need to. In the eyes of the government, individuals are identified by their social security number. The irs issues this number so it.

Here’s what we’ll cover: Make adjustments as needed for changes in tax laws, employee information, or company policies. Choose a payroll system 2.

Become a certified payroll professional, if possible. Best overall outsourced payroll service: Interested in automated payroll processing?

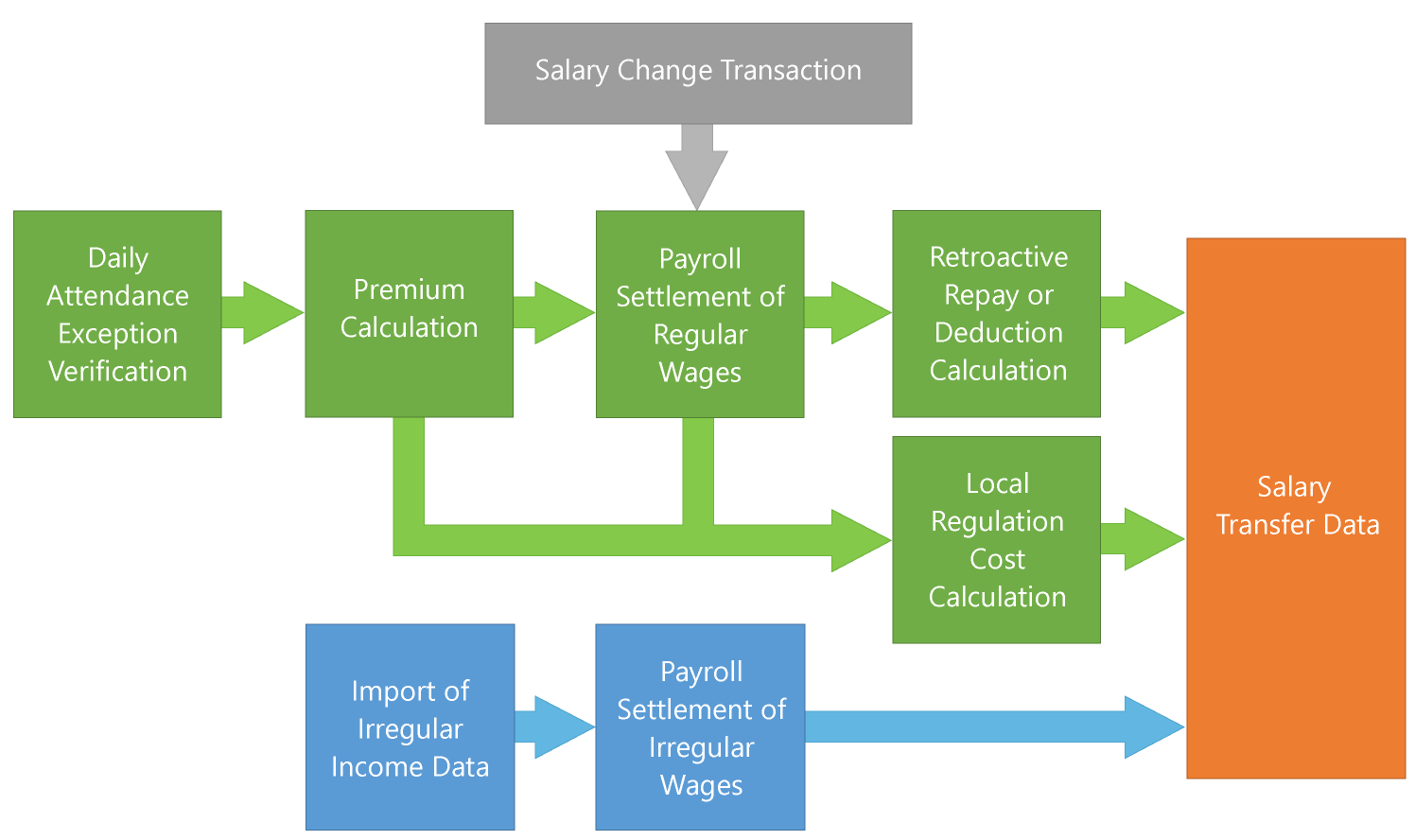

If you are running payroll manually, the process will be important to ensure that you don’t overlook any critical detail when processing payroll. What type of business structure is best for a payroll. For processing employee payroll, there are eight basic steps from start to finish:

However, as soon as you hire your first employee,. Though not a requirement, the bureau of labor statistics says certified payroll professionals have an advantage over. Not filling out or filing employee tax forms correctly also impacts your ability to pay the company’s payroll taxes.