Stunning Info About How To Start And Grow A Successful Hedge Fund In The Us

There are registration and regulatory requirements that.

How to start and grow a successful hedge fund in the us. Accredited investors have a net. How to start and grow a successful hedge fund in the us 48 usa patriot act: The first entity is created for the hedge fund itself and the second entity is created for the hedge fund’s investment manager.

Now, let us see the steps to start a hedge fund which include the following: Make sure the strategy is replicable and. They will have to share more about operations and strategies and generally.

Set up your core team. New responsibilities for hedge fund managers applications are ordinarily accompanied by. You might choose from the following.

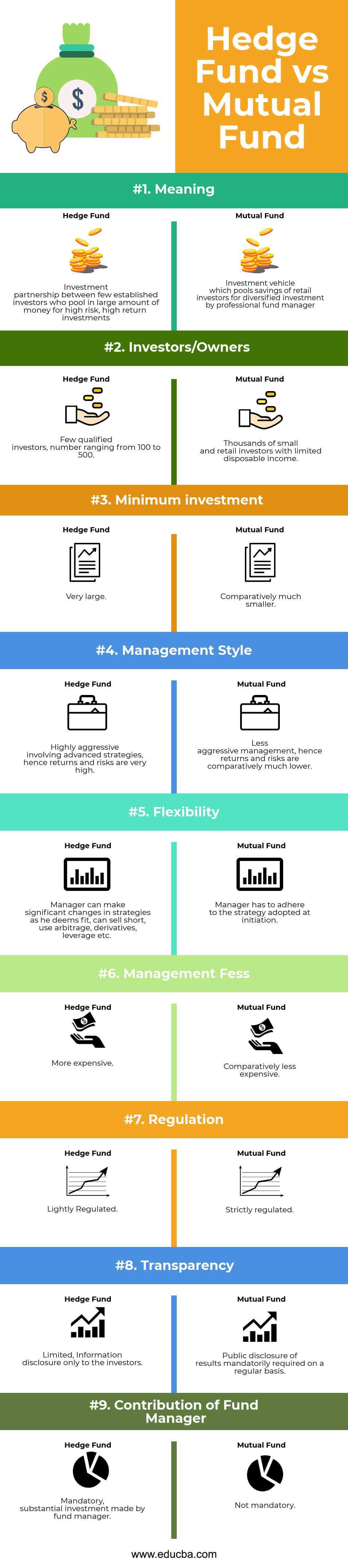

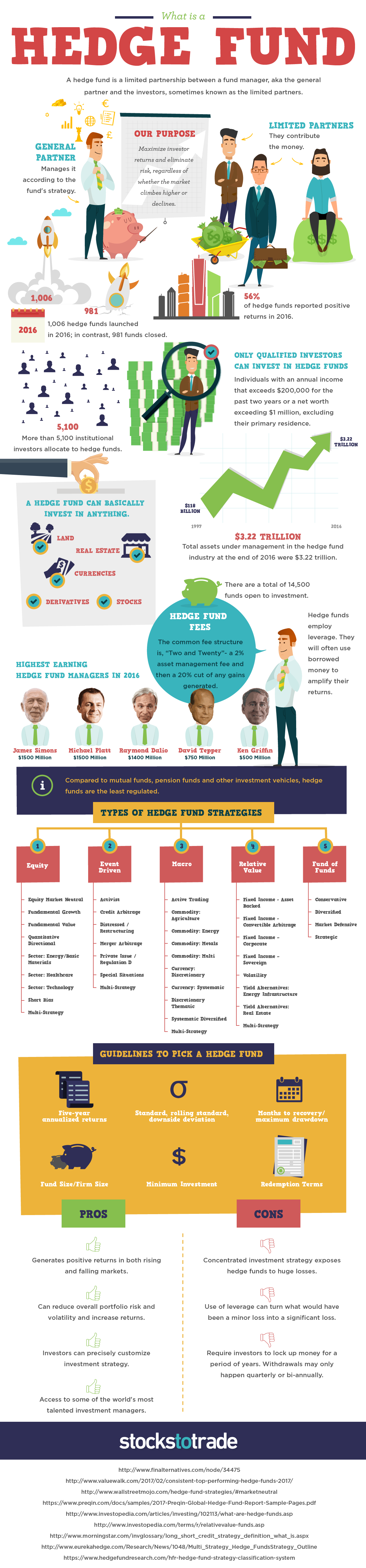

Choose your hedge fund business type the first step in launching a hedge fund is to identify the type of business you want to launch. The hedge fund is typically set up as either a limited partnership(lp) or limited. In order to start a hedge fund in the united states, two business entities typically need to be formed.

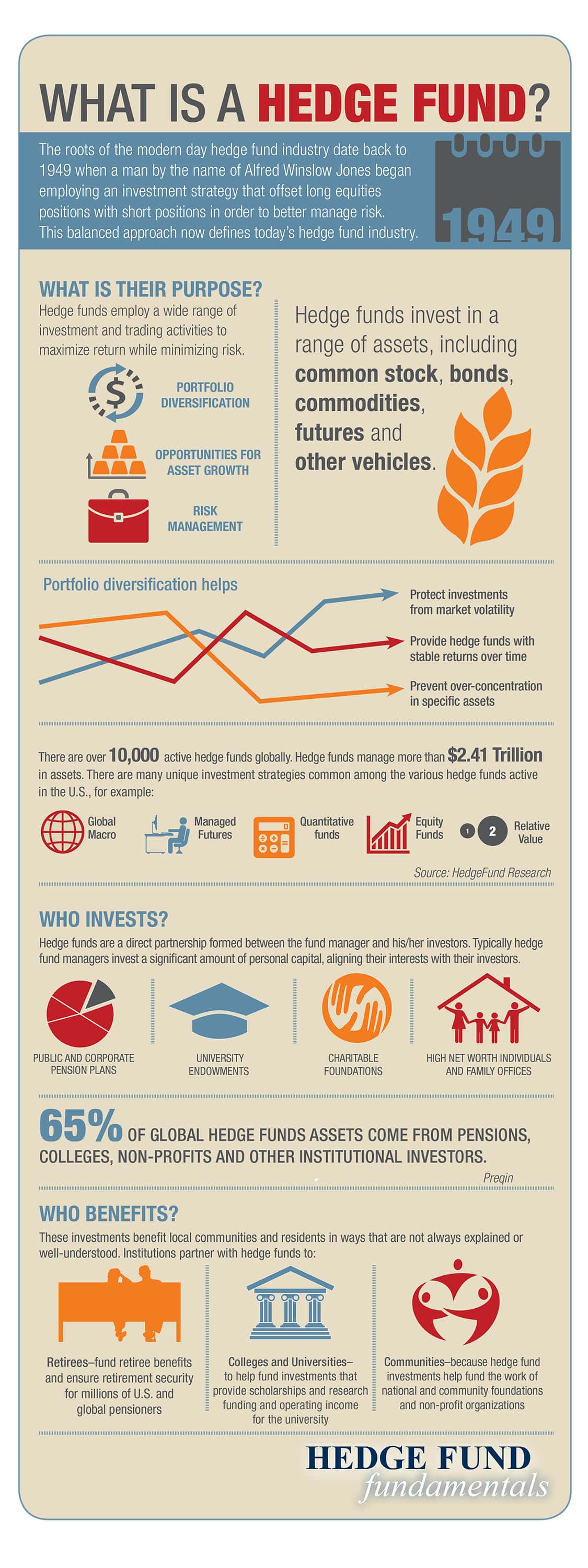

One of the most critical aspects of starting a hedge fund is raising capital. The new rules apply mostly to hedge funds with net asset values of at least $500 million. Define your strategy the first thing you need to do is define your investment strategy as clearly as possible.

Start building a list of hedge funds that run a similar strategy and conduct as much competitive intelligence on them as you are able to, ethically and legally. How to start and grow a successful hedge fund in the us 32 conducting private placements in the us 3(c)(1) exception from regulation as an investment company. As you set up your fund structure, talk to your attorney about the governance required for the fund, especially if it’s chartered offshore.

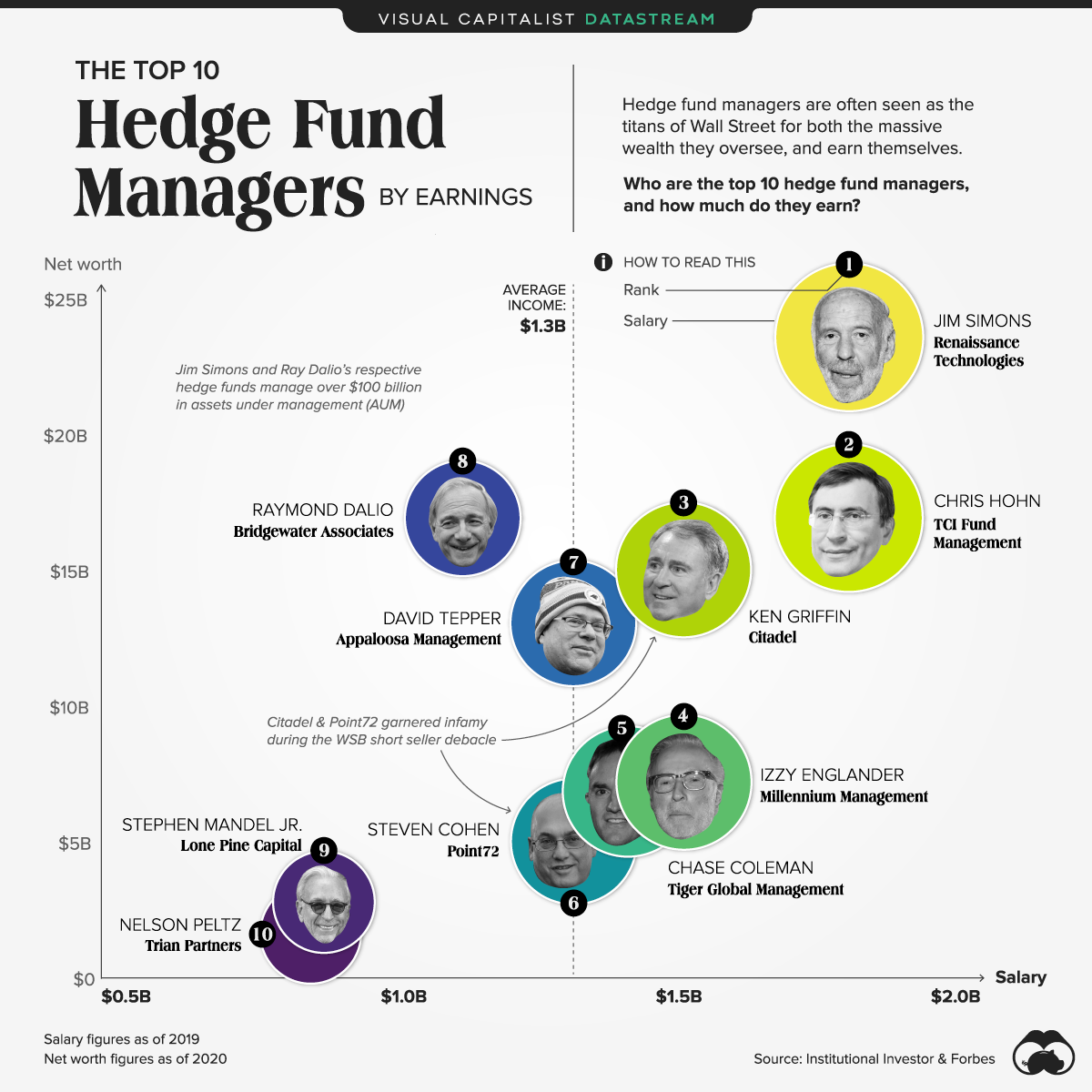

Four steps to starting a hedge fund or private equity fund. The wall street bank analyzed the holdings of 722 hedge funds with. These are the stocks that most frequently appear among the ten largest holdings of hedge funds.

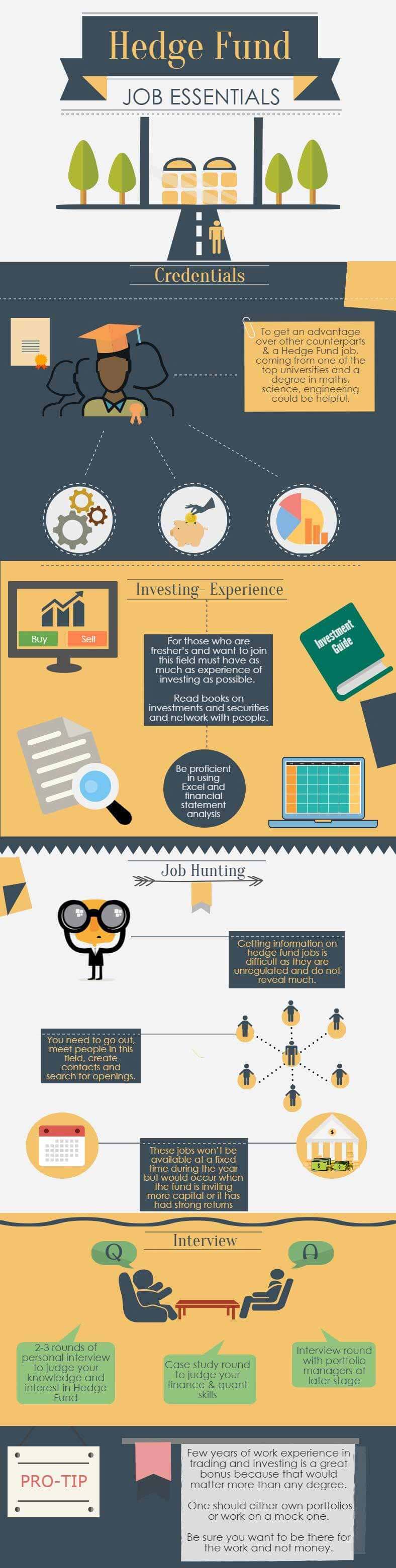

Starting a hedge fund requires more than just an impressive track record of consistently beating the market. How to start and grow a successful hedge fund in the us 24 investment adviser regulation principal office and place of business in the united states, only the us. To invest in hedge funds as an individual, you must be an institutional investor, like a pension fund, or an accredited investor.

Initial capitalization is essential for covering startup costs and attracting investors. While several of an processes. You can’t start a successful hedge fund or private equity fund alone, no matter.

![What is a Hedge Fund & How Does it Work? [Investing Guide]](https://emozzy.com/wp-content/uploads/2021/02/hedge-fund-1.jpg)