Real Info About How To Write A Deed In Lieu Letter

How do i write a letter requesting a deed in lieu of foreclosure?

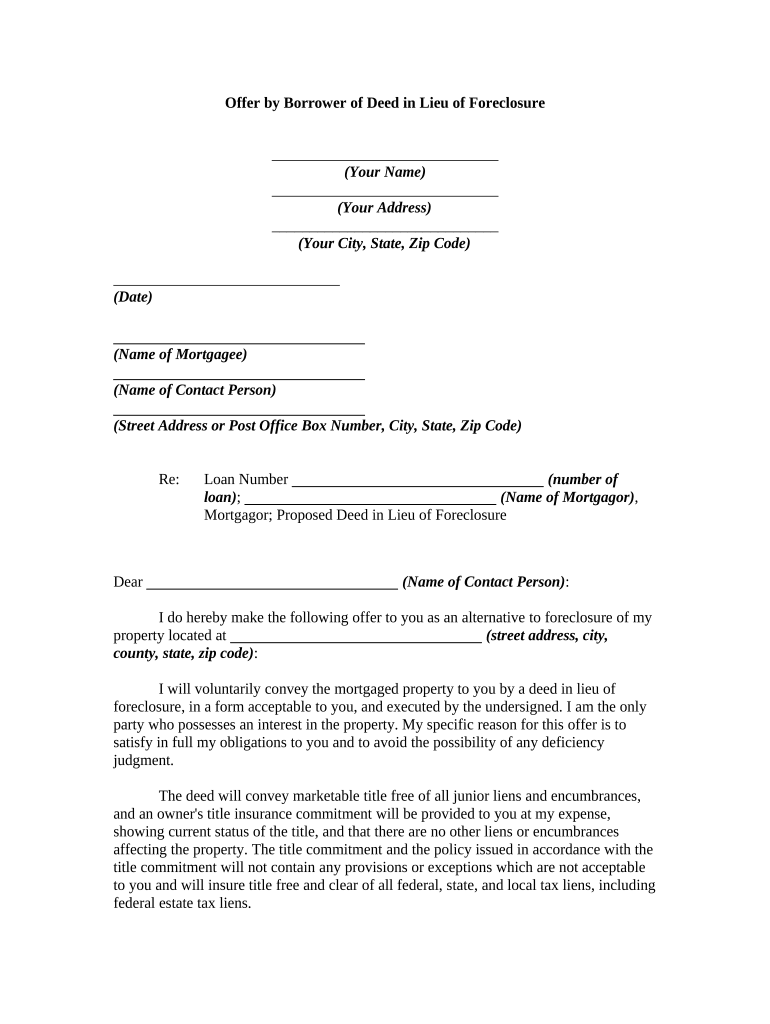

How to write a deed in lieu letter. Explain your situation and ask for a loss. Also, there is an option to communicate with your writer, share additional files, and clarify all the details. Both a lender and a borrower can initiate negotiations about a deed in lieu of foreclosure, but the latter ones tend to come.

If you apply for a loan modification, short sale, or. The act of giving property back to the lender without foreclosure. Rather than continue to make payments on the house, the homeowner asks the bank to take the deed to the house instead of (in lieu) of foreclosure.

Explore the workings of a reverse mortgage deed in lieu of foreclosure when your reverse mortgage owing balance exceeds the home value. How to write a deed in lieu letter. Home ownership is an expensive proposition, not only.

How to use a deed in lieu of foreclosure. Thanks for your question and good evening.have you heard anything from lender here about a deed in lieu.?usually once you contact them then they will send. Personal finance mortgages.

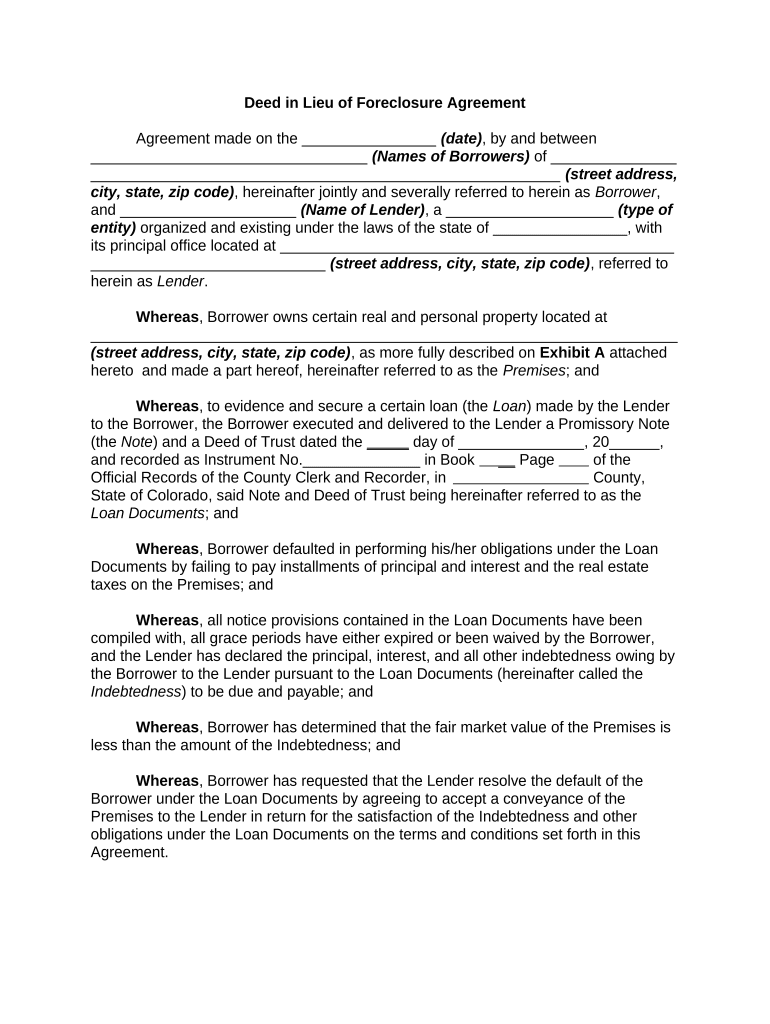

To complete the deed in lieu, the borrower will be required to sign a grant deed in lieu of foreclosure, which is the document that transfers ownership of the property to the bank,. What realtors® need to know. The bank may consider this if there aren't any significant liens on the property, such as a 2nd mortgage.

A deed in lieu of foreclosure is a legal agreement where a homeowner/borrower gives the legal title of their home to their lender. What is a deed in lieu of foreclosure. Here's when to consider it.

How to write a deed in lieu letter. 461527 / apr 6, 2022. For many homeowners, foreclosure is a stressful and devastating experience.

A deed in lieu of foreclosure is a crucial financial option that allows homeowners to transfer their property title to their lender in exchange for mortgage debt. If you want to avoid foreclosure with a short sale, deed in lieu, or loan modification, you might need to write a hardship letter. Deed in lieu of foreclosure:

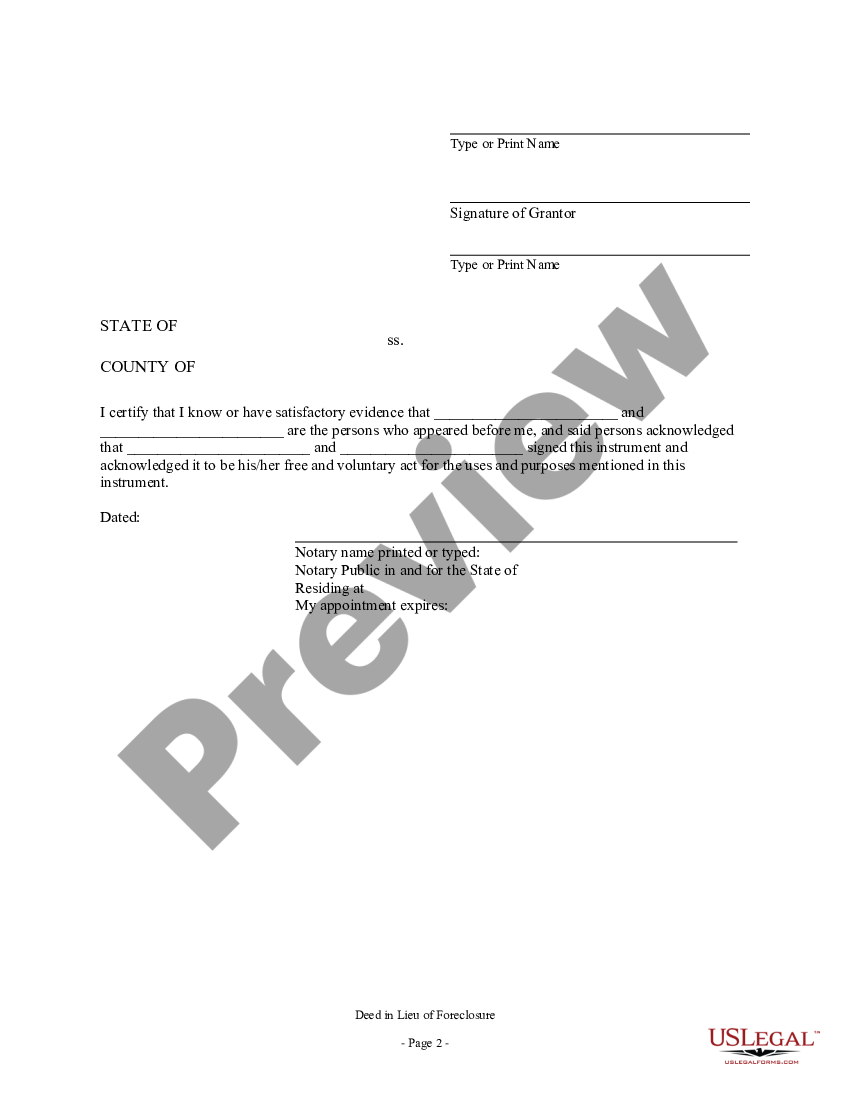

This form must be signed by all parties required to execute the deed, to convey legal title to. Contact your lender’s loss mitigation department.

.png)